This article is part of the series: Revealed: 4 secret ways to quadruple your real estate investment return today.

—

This only holds true under specific circumstances. Borrowing debt that your underlying investment cannot service is a ticking time bomb and you will get caught at some stage. You should use analysis software to do a ‘worst case scenario’ on your potential real estate investment to eliminate risk.

In real estate investment if you refine your risk back to the most basic form you end up with one thing: Risk is the investments likelihood to lose money. So how do we counter this? You counter this by analysing your properties cash flow in a worst case scenario.

In my opinion your single biggest risk when investing in residential real estate is an interest rate hike. This is largely given that part of generating exceptional IRR’s is borrowing as much as possible (up to the entire purchase price of the property plus costs of transfer) but still being able to service that debt. So how do we do a worst case scenario for the interest rate? Let’s look historically at the highest the South

African interest rate has ever been. In 1998 the interest rate reached an all time high of 24%.

Plugging 24% into the analysis is overkill because it’s highly unlikely that we will see these kinds of interests rates again unless there is a fundamental shift in forces that shape our economy, however it’s a good exercise to see just how badly effected your cash flow becomes should the nightmare materialise. For me personally I prefer to plug in 18% interest rate. If I’m cash flow neutral or positive @ 100% loan to value (value purchase price) ratio in the analysis at this interest rate then it’s a go for me. A huge plus is that when your cash flow is neutral or positive at these very high interest rates and leverage your IRR at the current interest rate will be off the charts. When I talk about cash flow neutral or cash flow positive that is the income I’m receiving after all costs and variables associated with the property have been taken into account in the analysis. This ‘income per month’ line below demonstrates my cash flow on this analysis. Because it’s a positive amount I’m receiving it’s therefore cash flow positive after all the variables that were listed above in point 1 have been taken into account. Cash flow neutral would be the point where the ‘income per month’ is zero after all variables listed in point 1 have been taken into account. Cash flow negative would be where all the variables in point 1 result in the rental income falling short and a negative amount resulting. This means you have to put money in monthly. You want to void this at all costs.

![]()

In any case the more cash flow positive your property is mixed with the more leverage (gearing) you utilise means an exponentially higher IRR. Now try get your head around this: It also means less risk because your cash flow can absorb the higher interest rate payment required to service the debt should the interest rate increase. Okay let me spell it out: less risk more return! Who said more return requires more risk?!

This is why I love residential real estate investments, if you find the right property you can leverage them aggressively to benefit from outrageous returns all largely risk free. Just bear in mind nothing in this world is risk free but we can do our best to get as close as possible.

Something really great about the residential space is the rentals are extremely resilient and when a recession is experienced you seldom see a decrease in actual rental income. Instead we usually see a plateau for a few years in the growth of the rental income. So for me decreasing residential rental income due to recession is not a real risk and if you’re cash flow positive enough to be able to pass a worst case scenario a slight decrease won’t have any significant effect on your risk. According to TPN In 2020 (Pandemic peak) rental price growth was positive until the last quarter when it experienced a 0.75% decrease. In fact when interest rates spike residential rentals go up as more people are forced into rental due to their inability to purchase property. They are therefore forced into the rental market creating excess demand and driving rental growth.

What all this comes down to is finding the correct property and then analysing it correctly to get the results. In order to refine properties that you analyse look at unusually high rentals relative to the value of the property. These exist mainly in the low to medium residential properties but can also be found in the right properties for short term letting.

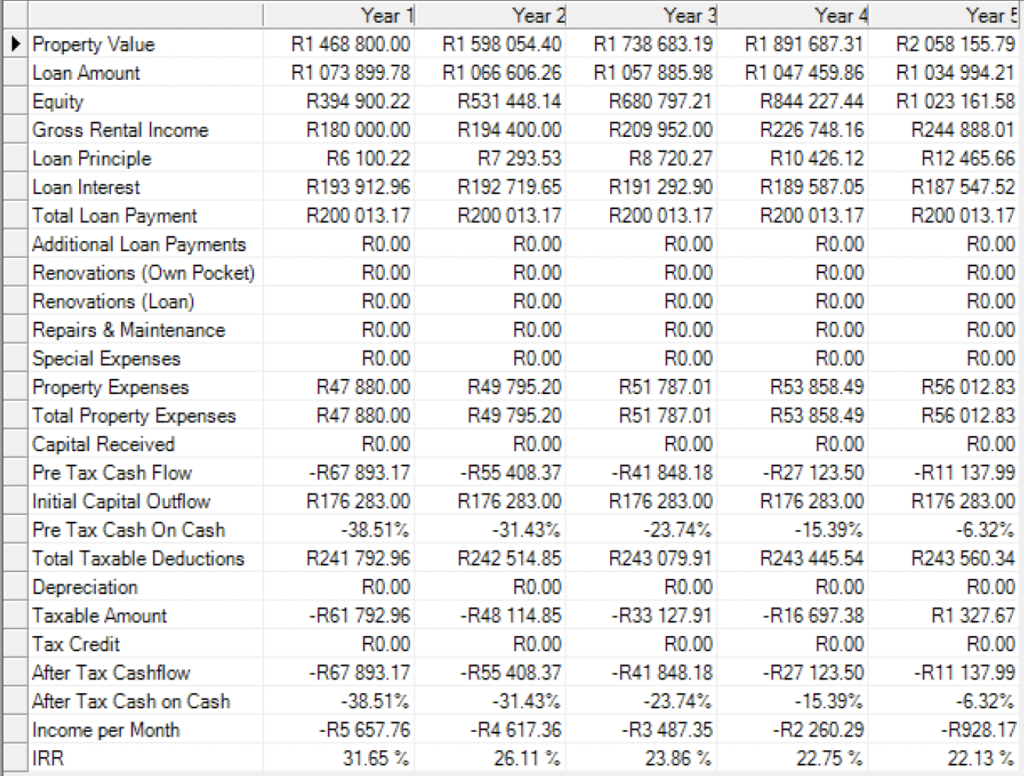

So let’s stress test this real estate investment and apply an 18% interest rate to it in a worst case scenario. See below:

As you can see the cash flow is negative all the way to the 5th year and only becomes positives in the sixth year. If you invested in a number of properties like this and the interest rate really turned on you, you would have a huge problem servicing your debt and probably lose everything.

Your monthly rental for a property like this one would need to be R20,650.00 in order to be cash flow neutral at an 18% interest rate. So that gives you a good indicator of rental required relative to purchase price in order to mitigate your risk.

Cash flow is almost everything in real estate investing.

The better the cash flow the less risk and the higher the return. What’s great about this is every year you get a rental increase in residential real estate so your risk diminishes further as time passes by.

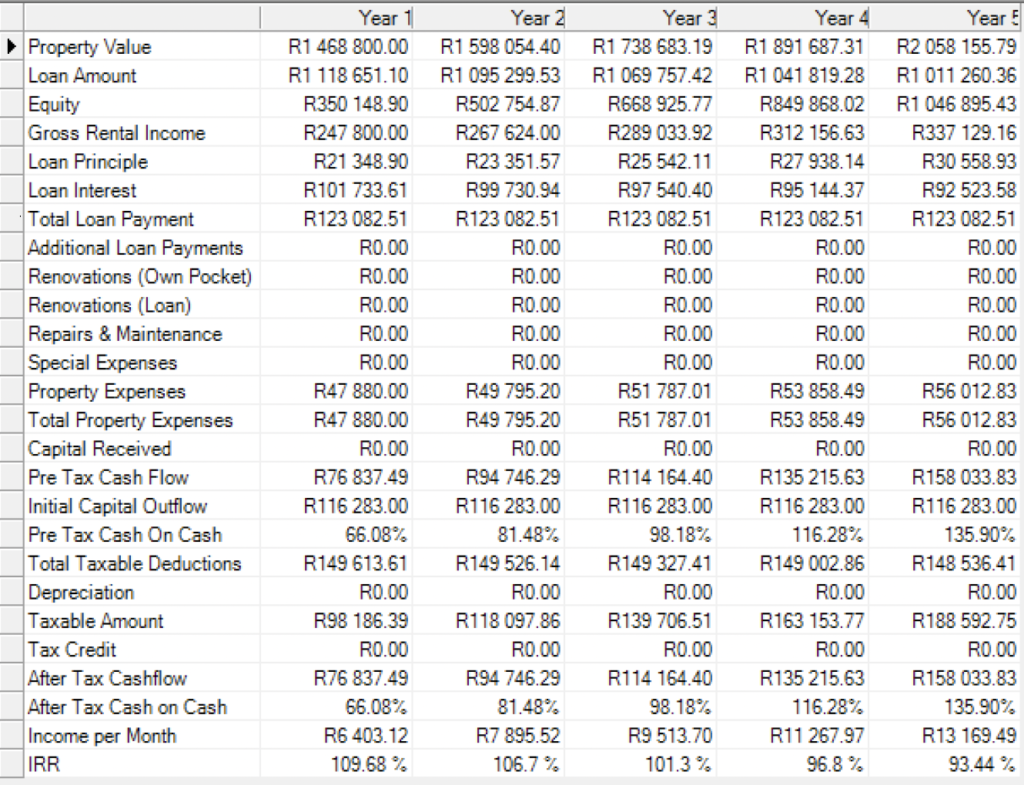

Now let’s say we find a property the same as the one we started with but with the rental of R20,650.00 we require to escape the risk of heavy interest rate hikes. See the IRR below.

As you can see we’ve increased cash flow from R1,292 to R6,942. We’ve also moved the IRR from 56.79% to 77.78% which is nice but we can do much better. You see the best way to increase your internal rate of return is to put less of your money in and more of the banks. LEVERAGE!

This is because your internal rate of return is based on what you are getting out relative to the money YOU have put in.

The banks money doesn’t count in this instance because it’s coming from an outside source. Simply put if you put 10 in and get 20 out a year later that’s a 100% IRR. But if the bank puts 5 you put 5 and you get 20 out. You’re getting 20 for your 5 that’s a 300% IRR. What’s even better is it’s exponential. Let’s do an exercise and take the analysis directly above and change only one thing.

Let’s change our deposit (the money we put in) from R120,000 to R60,000. See below.

As you can see we have increased the IRR from 77.78% to 109.68% by simply halving our deposit. Now trust me when I say it’s much easier to halve your deposit by borrowing a bit more money than finding a property for the same purchase price and deposit with a rental of R28,000 as opposed to the one above of R20,650. Properties costing R1,200,000.00 that generate R20,650 are already very rare. If you waited around for one that would generate R28,000 for that price you might take five years knowing exactly where and how to look. Rather pull the trigger on the rental that takes care of the risk. Then jack the IRR up with leverage. This is largely risk free because of your large rental income relative to purchase price.

Final exercise: Let’s do something crazy. Let’s say you’ve bought your first real estate investment and got it below market value and it’s now worth R500k more than when you bought it. Let’s say you go to the bank and ask for a facility to invest in more property against the equity in your current property namely the R500k. Let’s say they give you a R400k facility on a 20 year term.

Now what you do here is take that facility and use it for all the parts of the property we just analysed where you had to use your own money:

Deposit: R120,000

Bond registration cost: R24,380

Bank initiation fee: R6,038

Post, petties, fica: R1,485

Property transfer costs: R 24,380

Transfer duty: R6000

You are making money out of nothing.

Essentially you would be investing in real estate with none of your own money down. The bank will be financing the whole thing. Let’s analyse what this would mean:

Can you see your IRR now says infinite. This is because you’ve put zero in and you received something out. Try get that in a fund or trading stocks with this kind of clear understanding of the risk! If you are looking for this return while still having control over your risks, you need to be in full control of you investment. Your cash flow has obviously decreased as you used the facility to pay for the amounts that you were paying cash for. You therefore have slightly more debt to service but that’s irrelevant because your interest rate risk is largely covered and your internal rate of return is, well, infinite. On top of this you have a real estate investment you’ve paid nothing for that pays you R5,357.90 per month and gives you a capital increase of around R100,000 a year. These properties are out there, I’ve invested in properties like this for the last decade and these techniques work.

You are making money out of nothing.